Understanding the differences between secured and unsecured credit cards is essential for anyone looking to build or rebuild their credit. Both types of cards have their own advantages and disadvantages, so it’s important to choose the right one based on your financial situation and goals. In this article, we will explore the key disparities between secured and unsecured credit cards to help you make an informed decision.

Secured vs. Unsecured Credit Cards: An Overview

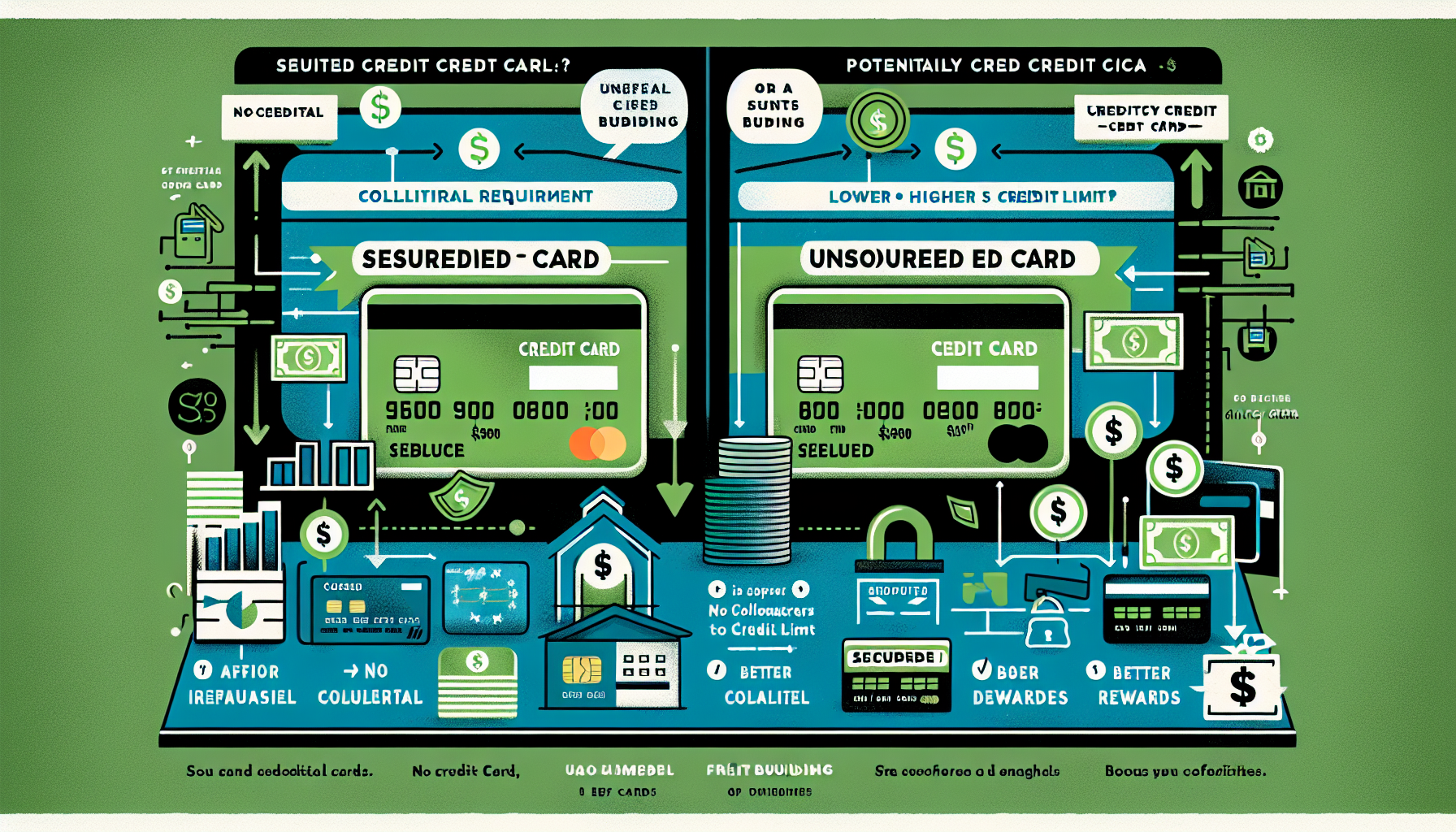

Secured credit cards require a cash deposit as collateral, usually equal to the credit limit on the card. This deposit protects the credit card issuer in case the cardholder fails to make payments. Secured cards are typically used by individuals with poor or limited credit history, as they provide a way to establish or rebuild credit. On the other hand, unsecured credit cards do not require a deposit and are based solely on the cardholder’s creditworthiness. These cards are more common and are often offered to individuals with good to excellent credit scores.

Secured credit cards often come with higher interest rates and fees compared to unsecured cards. This is because the issuer is taking on more risk by extending credit to someone with a less-than-stellar credit history. Additionally, secured cards may have lower credit limits and less favorable terms than unsecured cards. However, using a secured credit card responsibly can help improve your credit score over time, making it easier to qualify for better credit card offers in the future. Unsecured credit cards, on the other hand, typically offer lower interest rates, higher credit limits, and better rewards programs for cardholders with good credit scores.

Key Differences Between Secured and Unsecured Cards

One of the main differences between secured and unsecured credit cards is the impact on your credit score. While both types of cards can help you build credit, a secured card may have a more significant impact on your credit score if you have a limited credit history or a low credit score. This is because the issuer reports your payment history and credit utilization to the credit bureaus, which can help improve your credit over time. Unsecured cards, on the other hand, may not have as much of an impact on your credit score unless you consistently make on-time payments and keep your credit utilization low.

Another key difference between secured and unsecured credit cards is the approval process. Secured cards are easier to qualify for since they require a cash deposit as collateral. This makes them a good option for individuals who have been denied for unsecured cards in the past. Unsecured cards, on the other hand, typically require a good to excellent credit score for approval. If you have a limited credit history or a low credit score, you may have a better chance of being approved for a secured card. However, if you have a good credit score, you may qualify for an unsecured card with better terms and rewards.

In summary, understanding the differences between secured and unsecured credit cards is crucial for making informed decisions about your financial future. Whether you are looking to build credit for the first time or rebuild your credit after a setback, choosing the right type of credit card can make a significant difference in your financial well-being. By weighing the advantages and disadvantages of secured and unsecured cards, you can select the option that best suits your needs and helps you achieve your financial goals.