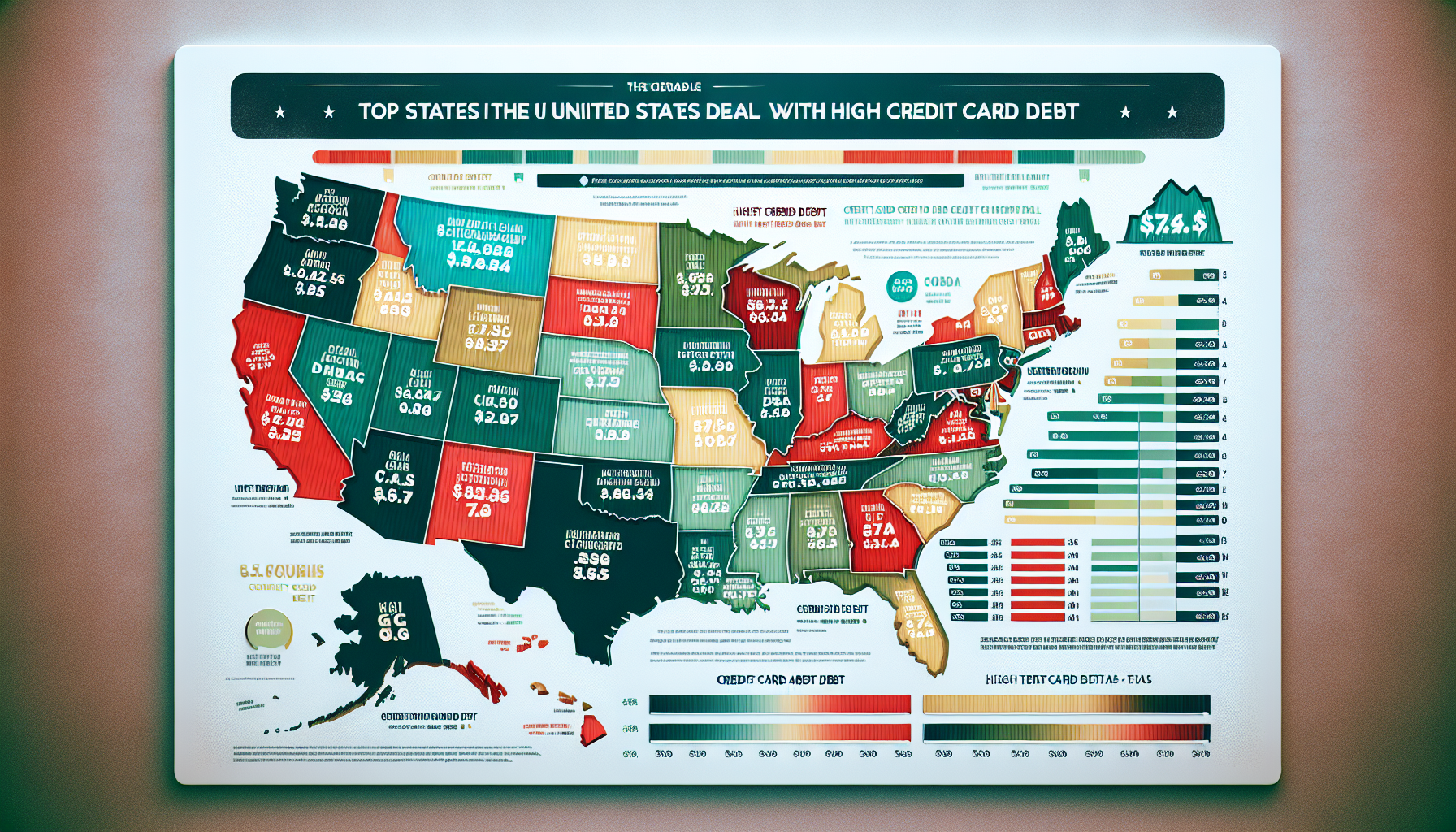

In recent years, credit card debt has become a pervasive issue in the United States, impacting millions of households across various demographics. As the cost of living rises and wages struggle to keep pace, many Americans find themselves relying on credit to bridge the financial gap. While this is a nationwide concern, the burden of credit card debt weighs more heavily on certain states. This article will delve into the top states battling credit card debt and explore the strategies and success stories that have emerged from these financial struggles.

Top States Battling Credit Card Debt: A Closer Look

California consistently ranks among the states with the highest levels of credit card debt. With its high cost of living, particularly in cities like San Francisco and Los Angeles, many residents find it challenging to manage their finances without relying on credit. The state’s average credit card debt per household often exceeds the national average. Economic disparities and the high cost of housing further exacerbate this issue, leaving many Californians in a cycle of borrowing and debt repayment that is difficult to escape.

Texas is another state grappling with significant credit card debt. Despite having a relatively low cost of living compared to coastal states like California, Texans frequently face high levels of indebtedness. The state’s vast size and diverse economy contribute to this issue, as many residents in lower-income areas struggle to achieve financial stability. The oil and gas industry’s cyclical nature also adds an element of unpredictability to Texan finances, making it harder for individuals to maintain consistent debt repayment schedules.

Florida, a state known for its retirement communities and tourism-driven economy, also faces substantial credit card debt issues. Seniors living on fixed incomes and seasonal workers experience unique financial pressures that often lead to increased credit card use. Additionally, the state’s susceptibility to natural disasters, such as hurricanes, can result in unexpected expenses that force residents to turn to credit cards. These factors combined make Florida one of the states most burdened by credit card debt.

Strategies and Success Stories from Across the Nation

In response to these challenges, California has implemented several initiatives aimed at reducing credit card debt among its residents. Financial literacy programs in schools and community centers have been expanded to educate individuals about responsible credit use and debt management. Nonprofit organizations have also stepped in to offer free or low-cost financial counseling services. Success stories from these efforts include individuals who have managed to pay off significant portions of their debt and achieve financial stability through disciplined budgeting and informed financial decisions.

Texas has seen positive results from community-driven financial assistance programs. Local credit unions and community banks have launched debt consolidation loans with lower interest rates, making it easier for residents to manage their debt. Additionally, statewide initiatives promoting financial education have empowered many Texans to take control of their finances. One notable success story involves a single mother from Houston who, through a combination of financial counseling and a debt consolidation loan, was able to pay off $20,000 in credit card debt and build a savings cushion for her family.

Florida’s approach to tackling credit card debt has included both preventative and reactive measures. State-sponsored financial literacy workshops targeting retirees and seasonal workers have been particularly effective. These workshops provide tailored advice on managing fluctuating incomes and preparing for unexpected expenses. Furthermore, community organizations have offered disaster relief funds to help residents avoid accruing debt due to natural disasters. A retiree from Miami, who attended one of these workshops, successfully navigated a financial crisis without resorting to credit cards, thanks to the practical advice and emergency planning strategies she learned.

As credit card debt continues to challenge many Americans, the experiences of states like California, Texas, and Florida offer valuable insights and hope. These states have not only highlighted the severity of the issue but also demonstrated that with the right strategies and community support, individuals can overcome financial hurdles. The success stories from these regions serve as powerful reminders that education, targeted assistance, and proactive planning are key to managing and ultimately reducing credit card debt. By learning from these examples, other states can implement similar measures to aid their residents in achieving financial stability and independence.